Table of Content

A savings account is an account you can open together with your local bank or credit union. It offers you a safe place to put your hard-earned cash that you just won’t (or shouldn’t) contact for a while. Your financial institution could require a minimum stability in your savings account, but having cash in savings is the point!

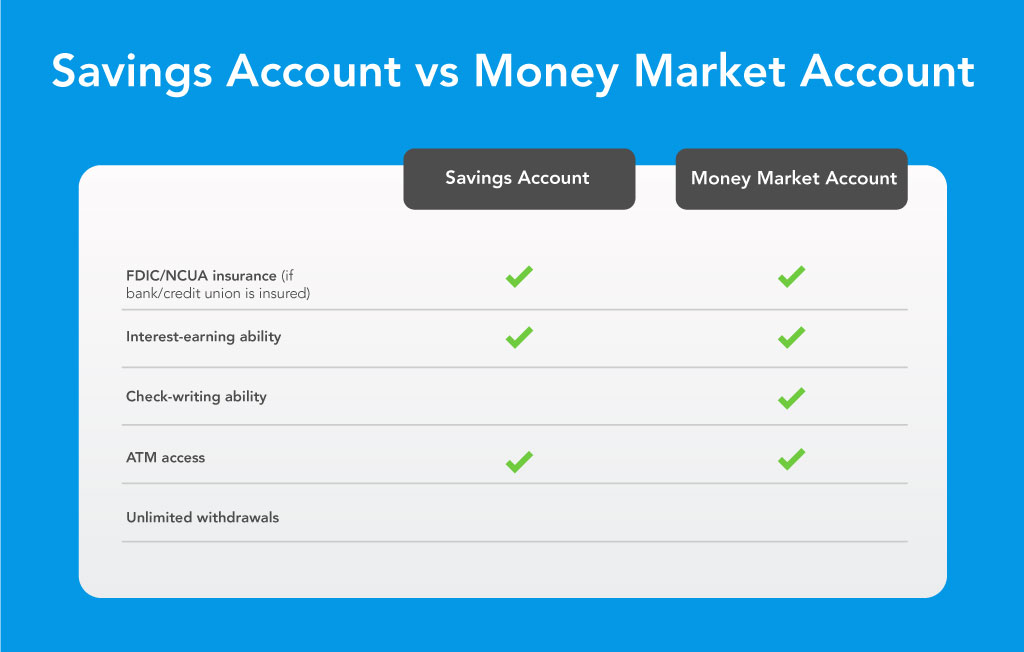

People tend to make use of MMAs for long-term financial savings they do not plan to the touch, and high-yield savings accounts for shorter-term monetary goals. Money market accounts, or MMAs, are also a type of financial savings account supplied by banks and credit unions which are federally insured. MMAs generally have extra competitive APYs in comparison with savings accounts.

High Yield Savings

You can withdraw your preliminary deposit and the interest as soon as the CD matures. Or, you could select to roll the whole amount over into a new CD. The yield on savings accounts is especially low, such that it often falls under the speed of inflation. Fixed-rate investments are especially weak in inflationary climates when prices and prices rise. Perhaps the greatest benefit of high-yield financial savings accounts is that they're extremely safe. One reason that money market funds aren’t your greatest option for financial savings is that they contain threat.

You're likely to face a fee or early withdrawal penalty should you do entry the funds. So no checks, transfers, or liquidity—that's the tradeoff for the larger yield on your deposit. Having money readily available in case of an emergency permits you to keep away from going into debt when you have an sudden automobile restore or medical invoice.

The Distinction Between Money Market And High-yield Savings Accounts

On the opposite hand, some banks might pay their highest curiosity tier on balances as much as a sure limit. This high-interest balance cap may be more common for high-yield financial savings accounts than cash market accounts. On the other hand, high-yield or high-interest financial savings accounts don’t provide the check-writing ability, however they typically have lower minimal stability necessities. If you’re working on building up your financial savings, they could be a suitable place for your money. Before you bounce proper in, though, notice that many cash market accounts have higher minimum balance necessities and might need extra fees than a typical financial savings account.

One of the most popular savings accounts for retirement is the Individual Retirement Account . An IRA, specifically, comes with tax advantages which will show as advantageous as high interest rates. A money market account is basically a hybrid between a checking account and a financial savings account. But you’ll additionally be ready to write checks and make debit purchases, identical to a checking account. To perceive cash market accounts and high-yield financial savings accounts, you must know slightly bit about savings accounts generally and how they’re regulated.

Different Rates Of Interest

You’ll additionally find financial savings accounts for teenagers and specialty financial savings accounts, corresponding to a Christmas Club account. Since guidelines and yields for cash market accounts range greatly, it pays to shop round. One good place to start is together with your present financial institution. Online financial savings accounts additionally tend to have very low minimum stability necessities.

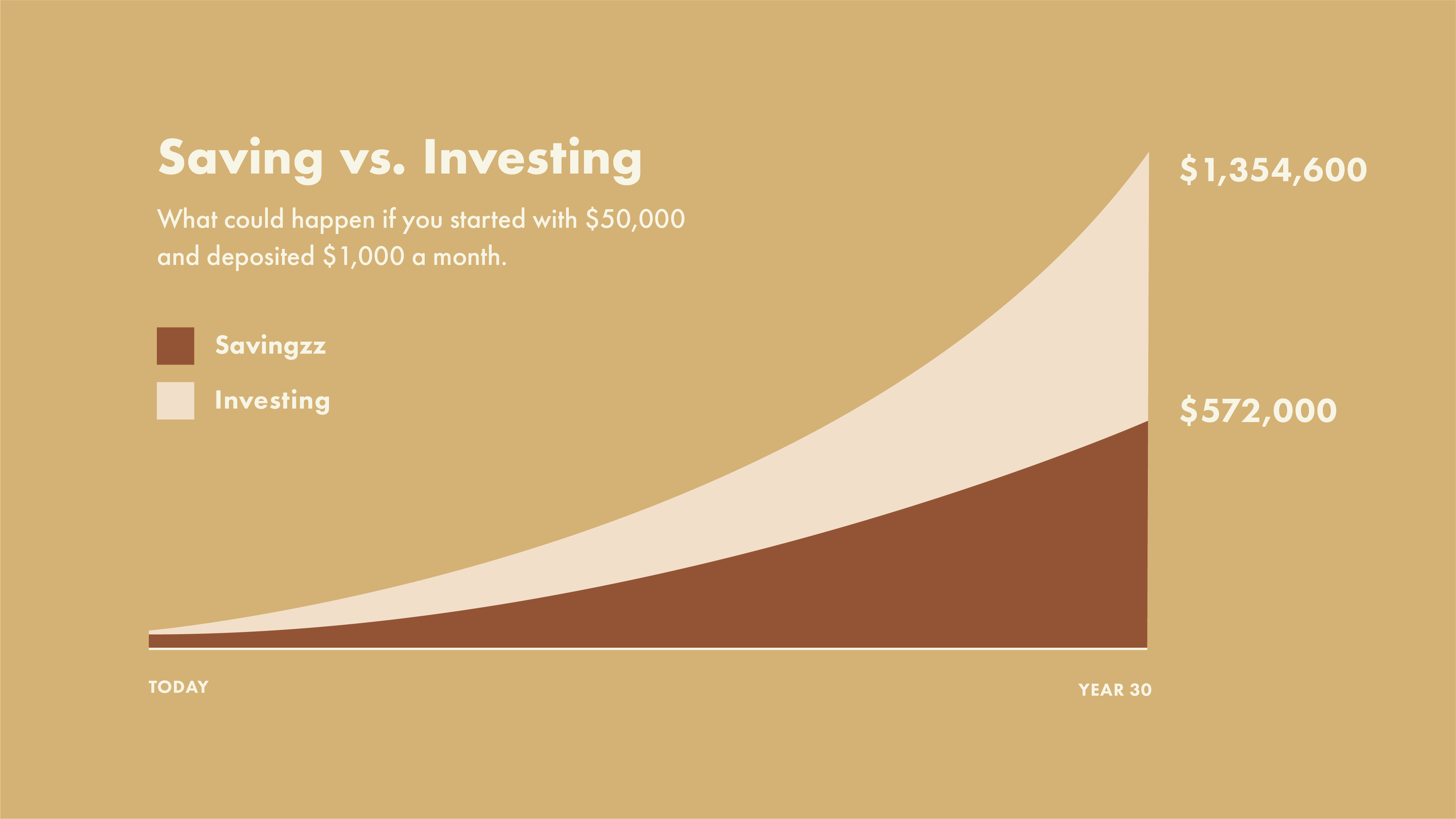

You don’t have to spend time making a withdrawal or transferring cash to a checking account first. The main difference between them is that MMAs usually have higher APYs than savings accounts and have greater minimum balances. So, for example, when you put $10,000 into a conventional financial savings account that pays 0.01% in interest, then that compounded month-to-month curiosity would pay $1 annually. Comparatively, with all other elements remaining fixed, a high-yield financial savings account paying 1% in curiosity would earn $100.forty six in the identical time period. A high-yield financial savings account is a savings account that generates much more interest than a standard financial savings account.

Key Benefits To High-yield Financial Savings And Money Market Accounts

However, you may have to make a higher opening deposit and maintain more within the account to be able to earn interest. To be clear, money market accounts and savings accounts are each safe, safe locations for you to keep your cash. Neither is an various selection to a checking account — these accounts are for saving, not spending — but like a checking account, you can open one at a financial institution or credit score union. The differences in interest rates between the two types of accounts are normally minor. A high-yield financial savings account works much like regular savings accounts, although some have the next opening stability or minimal stability requirement. While you proceed to have quick entry to your savings, you don’t have the check-writing capability.

Since you agree to go away your cash with the financial institution for a set time period, you could get the next interest rate on a CD than on a financial savings account. For instance, as of March 21, 2022, the national average price for CD accounts ranged from zero.03% for a one-month CD to zero.29% for a 60-month CD, based on data from the FDIC. The fee you earn with a financial savings account can depend upon what sort of financial savings account and where you bank. If you open a financial savings account at a traditional brick-and-mortar financial institution, your rate of interest will likely be lower. But a high-yield savings account at an online bank, on the other hand, may come with a much more competitive fee.

Very low charges imply these funds may not outperform a financial savings account as soon as you are taking fees under consideration. So do your research before shifting your cash into a money market fund. They may not yield as excessive a return as the inventory market, however they do carry a lot less risk and tend to have higher returns than an interest-bearing savings account.

However, this insurance coverage doesn't protect the value of your investments. The difference is just actually relevant in case you have a big sum to keep away from wasting. Clearly, the Prime Money Market Fund provides a barely better return. The SEC Yield relies on the return of an funding over the past 30 days. As of the time of writing , the Prime Money Market Fund presents an SEC yield of 1.76% (and a compound yield of 1.77%). The similar story about leaving cash on the street still most definitely applies right here, however to a good higher extent.

Some cash market and high-yield savings accounts supply interest rates of 0.80% and even 1.25% . This might not compete with the present inflation fee but might help fight it to some degree. Money market and high-yield financial savings accounts are FDIC insured for as a lot as $250,000 per individual, allowing the insurance coverage coverage to stack for joint accounts. This insurance would cowl you as a lot as that restrict if your bank or credit union was to fail for some purpose.

Whether you realized it or not, that hard-to-open piggy financial institution was teaching you how to save your cash. To the most effective of our information, all content is correct as of the date posted, although presents contained herein could now not be out there. The opinions expressed are the author’s alone and haven't been provided, permitted, or in any other case endorsed by our companions. Taking cash out of a CD earlier than it matures might trigger an early withdrawal penalty, inflicting you to forfeit some or all of the curiosity earned. Laddering CDs means opening a quantity of CD phrases with different maturity dates, and every CD may also earn a unique interest rate and APY.

No comments:

Post a Comment