Table of Content

One of the most well-liked savings accounts for retirement is the Individual Retirement Account . An IRA, in particular, comes with tax advantages that will prove as advantageous as high interest rates. A cash market account is basically a hybrid between a checking account and a savings account. But you’ll additionally be capable of write checks and make debit purchases, similar to a checking account. To understand money market accounts and high-yield savings accounts, you must know slightly bit about financial savings accounts in general and how they’re regulated.

Most top tier online-only high-yield savings accounts don’t cost annual fees nor require minimal balances. Consequently, you should open a high-yield financial savings account as quickly as you'll find a way to to benefit from the rates of interest. Leaving your money underneath your pillow will trigger you to lose out on a lot of passive features and inflation.

Money Market Account Vs Financial Savings Account: What’s The Difference?

Read extra about Select on CNBC and on NBC News, and click here to read our full advertiser disclosure. Investopedia requires writers to use main sources to assist their work. These include white papers, authorities information, unique reporting, and interviews with industry consultants.

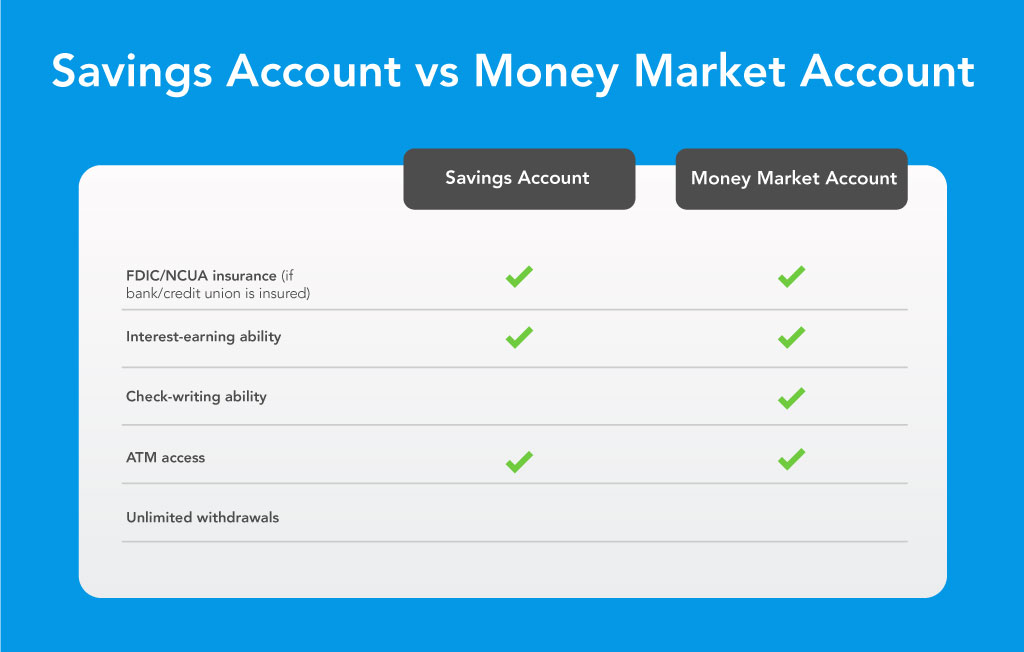

Money market accounts often, however not always, come with a debit card, ATM card or checks, and those are options you sometimes don’t get with a financial savings account. Some banks enable MMA account holders to write checks and allow using a debit card for purchases, transfers, and withdrawals at the automated teller machines . Although the Federal Reserve lifted withdrawal restrictions underneath Regulation D in 2020, your bank should restrict your capability to access the funds in your account. Money market funds offer slightly greater returns than high-yield financial savings accounts do, but you may wonder whether they’re really a higher choice in your financial savings. If you’re somebody who struggles to depart your financial savings alone, a financial savings account might be better for you. Since the money in a financial savings account isn’t accessible with checks and a debit card, it’s easier to leave it untouched.

Cash Market Account - 400% Apy

That stated, with the present banking environment, high-yield savings accounts will in all probability be the proper reply for most shoppers. These accounts can provide considerably extra interest with a considerably decrease minimal stability requirement. So most customers will most likely be better off taking the upper rate of interest of a high-yield savings account and simply spending their money from checking as wanted. Though cash market accounts are a sort of financial savings account, they provide slightly different benefits.

Money market funds are best used for financial savings with a higher fee of return than bank or credit score union accounts with much less volatility than the stock or bond markets. With a medium-term financial savings goal, you’ll probably be saving for greater than a couple years, however less than a decade. You would possibly see some banking institutions describe a cash market account as a “high-yield savings account.” Other banking establishments make a distinction between the 2. We’ll describe the kind of high-yield savings account that’s considered completely different from a cash market account. Whether it is sensible to open a financial savings account, cash market account or CD to earn curiosity is dependent upon your objectives and how a lot access you should your cash.

Given that MMAs sometimes want larger minimum balances, it’s no shock that MMAs have at all times had higher interest rates than their savings account counterparts. Money market accounts also are inclined to tie up extra of your money, requiring higher minimum account balances than a high-yield savings account. While each accounts can include monthly upkeep fees, it’s more and more easy for shoppers to find no-fee accounts. Money market accounts can pay the identical fee of interest as a high-yield financial savings account. And whereas not impossible, it's rare, if ever, that a normal money market account can pay that sort of return. There’s an essential difference between cash market accounts versus money market mutual funds, so don’t confuse them.

You’ll most likely also need to make the next preliminary deposit or keep the next month-to-month stability in your cash market account. Whether a CD, financial savings or money market account, the right type of account for you is determined by your financial savings needs and targets. Some accounts offer more access to your money, while others offer greater curiosity. If you have a CD, financial savings account or cash market account at an FDIC member financial institution, you’re lined as much as $250,000 per depositor, per account ownership type, per financial establishment.

Money market accounts and financial savings accounts are equally safe locations for shoppers to maintain their financial savings. However, it’s necessary to open accounts at banks that are lined by FDIC insurance coverage. A cash market account provides the most effective of both worlds with extra flexibility and better rates of interest. So should you're just starting out to save heaps of and may't keep the required steadiness, it won't be the solely option for you. Having a financial savings account is a vital part of personal finance management.

Keep in mind though, that identical to any other funding, there is no assure of returns. Money market funds are mutual funds which might be offered by brokerages, investment firms, and monetary services firms. They pool cash from a number of buyers and put money into high-quality, short-term securities. While they are technically investments, they do act more like on-demand cash accounts since the money is definitely accessible. In general, money market accounts are inclined to have more potential maintenance fees than the average high-yield savings account.

Money Market And Financial Savings Accounts Overview

So sure, the rates of interest may be low, but theyaren’tirrelevant.Their rates earn vital money over the years and stand in opposition to inflation. For specific recommendation about your distinctive circumstances, you could wish to consult a professional professional. Any historical returns, anticipated returns, or chance projections might not reflect precise future performance. While the info Ally Invest makes use of from third events is believed to be dependable, Ally Invest can not make positive the accuracy or completeness of data offered by clients or third events. Prospective traders should discuss with their personal tax advisors relating to the tax consequences primarily based on their explicit circumstances.

Anything over that number and the establishment might cost an excess withdrawal payment. Money market accounts and high-yield savings accounts earn you far greater interest than the standard savings account, though they have higher minimal balance necessities. With a cash market account, you probably can write checks or make a limited variety of debit purchases similar to you would with a checking account. These are financial savings accounts supplied by depository establishments like banks and credit unions. That means that they retailer cash, pay interest and are insured by the FDIC. However, they also share some traits of a checking account.

No comments:

Post a Comment